Together with the increasing price of medical care insurance choosing the very best Medicare policy can acquire essential. It’s all about picking out the appropriate policy to match your needs. A lot of us have doubts about which is your most useful medicare supplement strategy in 2020. Which medicare coverage to choose? Which Medigap policy would be your ideal?

We are Anticipating extensive fluctuations in Medicare Supplement plans in 20 20 . There Could be several adjustments in Medicare Part B and Medicare Supplement Strategy F.

Matters to Remember while picking out your Medicare prepare:

● Eventually, each business offers Exactly the very same or identical strategies.

● The policy ensured on your Policy isn’t very likely to change once it’s declared.

● Costs may differ between Companies. Thus, pick the one which provides your required insurance in the bottom price.

● There can not be one finest plan. You have to pick the one which matches your requirements.

● Compare plans accordingly you Know that policy covers the services that are required.

● Some programs are all extremely costly. But You might not desire them, so don’t waste money on needless providers.

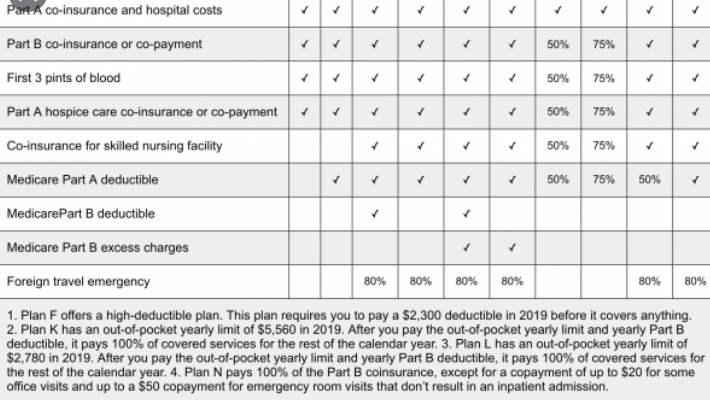

There really are a large number of Medicare ideas. To Locate the best Medicare supplement plans 2020, you Have to understand the services they pay. Each of the plans have become influential. Thus, rather than surfing through policies, you might start with a set of your requirements. Then examine the programs that meet your wants. Medicare is just a subjective issue. Only guess what happens satisfies your budgets and prerequisites better.

Authentic Medicare and Medicare Complement:

First Medicare is the plan That You Select for, and The complement medicare is rather practically the supplementary coverage. Your original Medicare insures your insurance, while supplements will soon be present to back up it when it’s necessary.

After the first limit is finished, the nutritional supplement will Enable you to extend the limit and supply you with all the required support.