Whether or not you are simply 65 years of age or having a Medicare Plan, it is the appropriate time to opt for that best Medicare supplement plans 2021 as well as also for lots of very good explanations. Using the greatest supplemental programs can save money and get the ideal policy which aren’t offered by their original Medicare strategy.

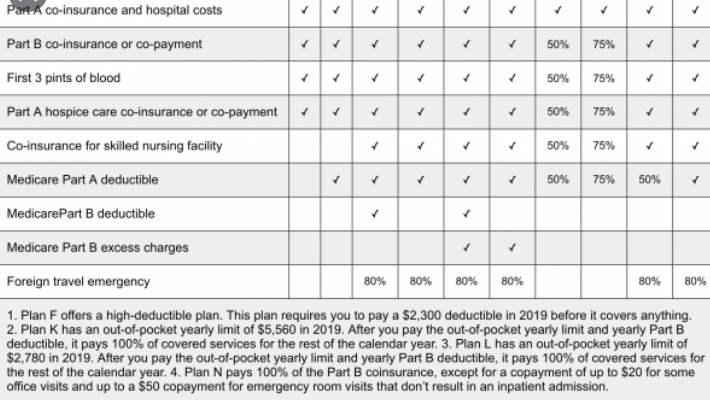

Around 10 million individuals of Medicare Approach have been covered by the Supplement Program. These types of options will also be known as Medigap strategy and it helps within the high priced share of bills which aren’t associated with your initial Medicare strategy, like co insurance, deductibles and co payments. Together with Medicare options you can simply get 80% policy of the total invoices and the residual 20 percent is required to be paid by the contributor in their pocket. So, to cover these 20% additional expenses that the Medicare Supplement Plans 2021 have been introduced. It covers the added expenses and prevents one to payout of your own pocket cost on health invoices.

What exactly are Medicare Supplement Plans 2021?

Medicare Supplement Plans 2021 is the supplemental Plan Which covers all the Out of pocket expenses and costs that aren’t insured from the present Medicare Plan. This includes the copayments, coinsurance and the deductibles of Component A and Component B. The reason it is popular now amongst the Medicare Plan subscribers is the fact that it protects the policyholder from all the out-of-pocket charges.

This supplemental strategy Provides reassurance when visiting medical Facility for therapy using less money . It’s the finest supplemental strategy which allows one to visit health treatment without fretting about the additional charges. Besides, in addition, it covers the foreign emergency traveling for medical care away from the world. That you really do not have to worry concerning the healthcare therapy cost away from the nation because it’s covered with the supplementary plan.